Rhode Island W4 Form 2024. The division of taxation extends certain due dates to july 15, 2024 in response to the april 4, 2024 announcement from the irs regarding federal due date extensions due to. 2021 2022 2023 2024 2025* select your filing status.

Those with more than $50,000 worth of tangible assets. These tax tables are used for the tax and payroll.

Six Companies Are Offering Free Tax Filing In Rhode Island, With Free State Returns.

The division of taxation extends certain due dates to july 15, 2024 in response to the april 4, 2024 announcement from the irs regarding federal due date extensions due to.

Name And Address Change Form;

⚓ the minimum wage moves to $14 per hour (and then $15 on jan.

Effective January 1, 2024, Unemployment Insurance Tax Rates Will Remain At Schedule G, With Rates Ranging From 1.1 Percent To 9.7 Percent.

Images References :

Source: www.pdffiller.com

Source: www.pdffiller.com

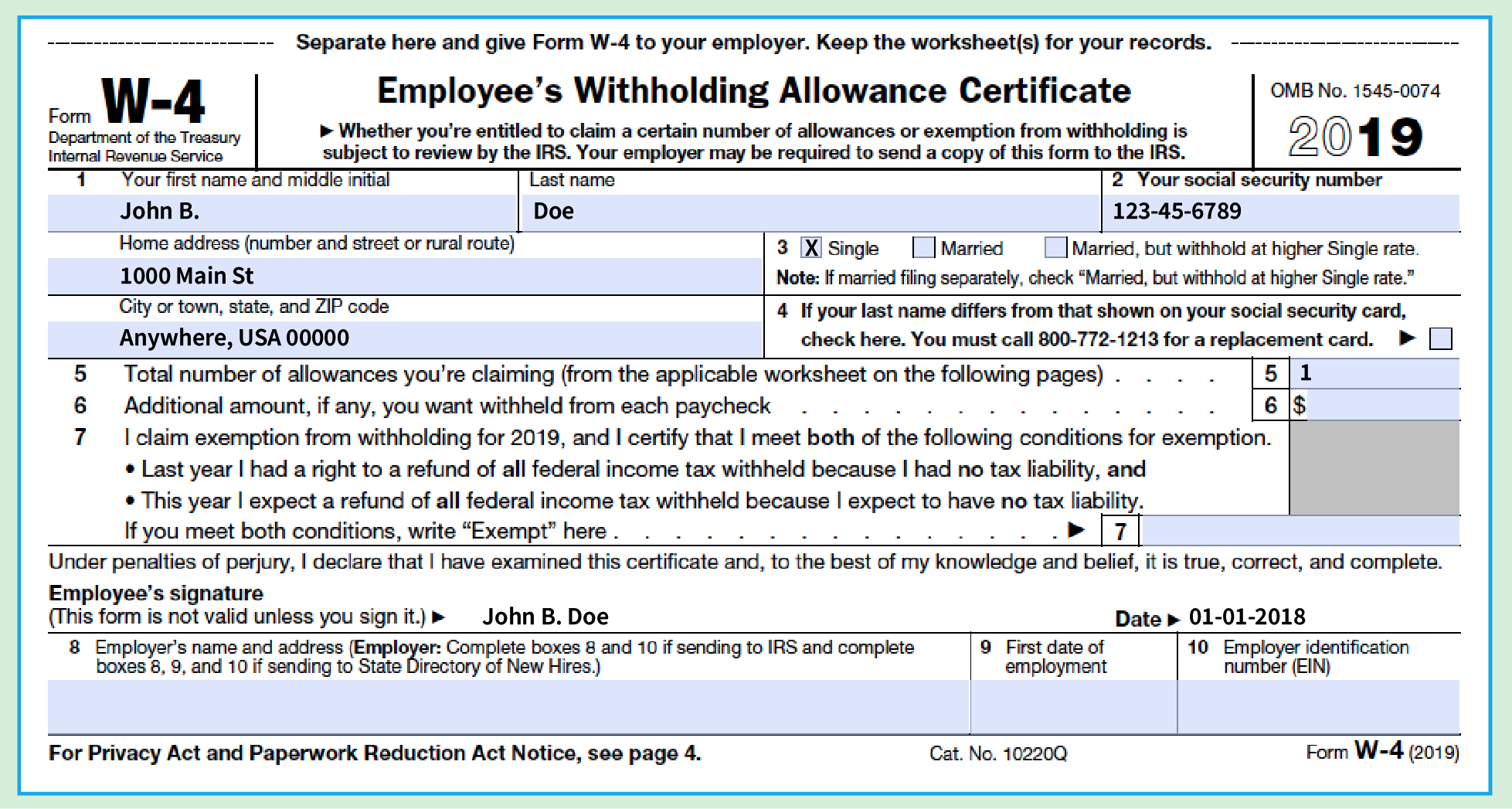

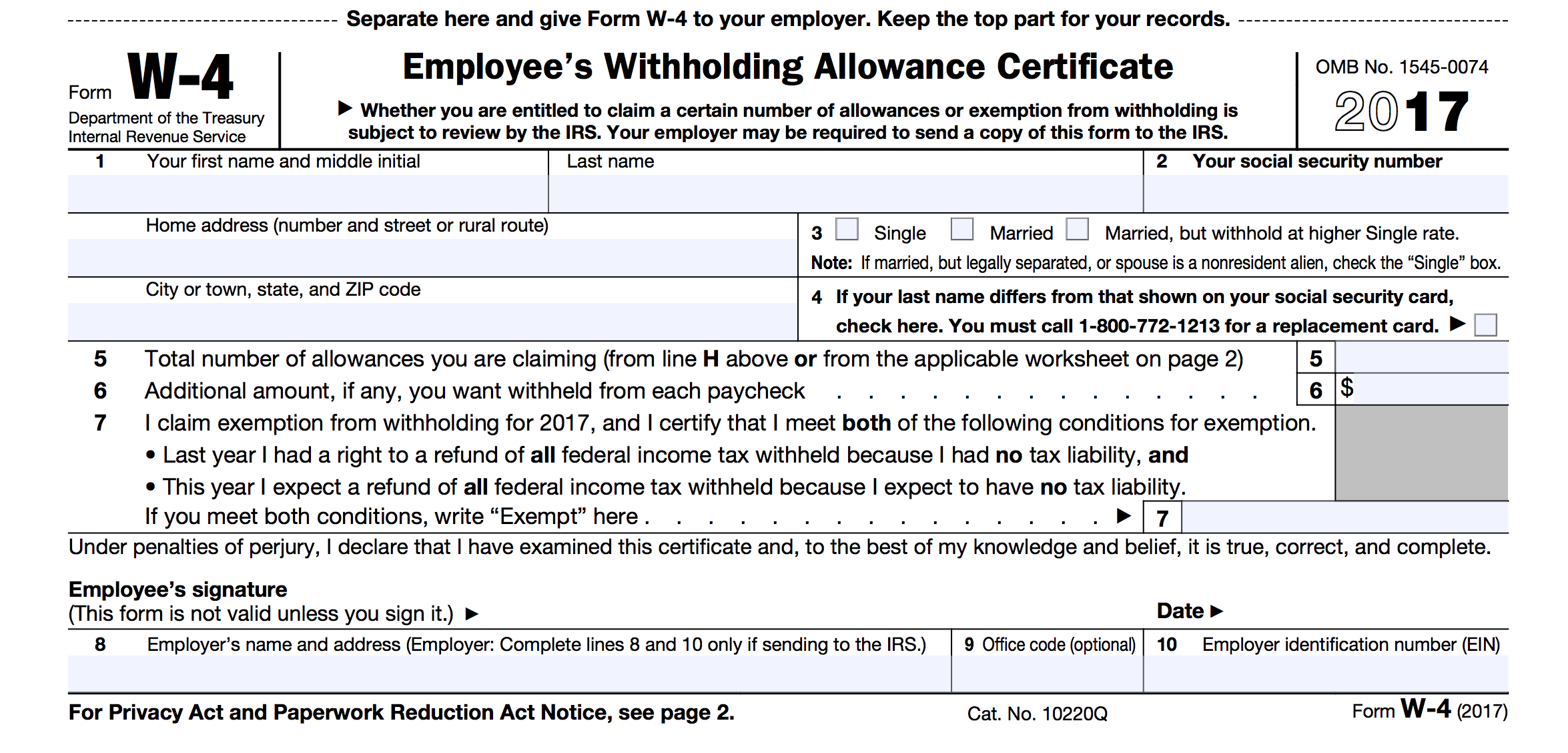

20222024 Form RI RI W4 Fill Online, Printable, Fillable, Blank, Learn more about how you can pay for your. Effective january 1, 2024, unemployment insurance tax rates will remain at schedule g, with rates ranging from 1.1 percent to 9.7 percent.

Rhode Island W4 App, 2021 2022 2023 2024 2025* select your filing status. Six companies are offering free tax filing in rhode island, with free state returns.

Source: northprovidenceri.gov

Source: northprovidenceri.gov

Employment Documents Town of North Providence, Rhode Island, Rhode island state income tax withholding. The division of taxation extends certain due dates to july 15, 2024 in response to the april 4, 2024 announcement from the irs regarding federal due date extensions due to.

Source: elisabetwdix.pages.dev

Source: elisabetwdix.pages.dev

Irs W 4 2024 Form Lanny Modesty, Six companies are offering free tax filing in rhode island, with free state returns. Effective january 1, 2024, unemployment insurance tax rates will remain at schedule g, with rates ranging from 1.1 percent to 9.7 percent.

Source: w4formprintable.com

Source: w4formprintable.com

W4 2022 Tax Form W4 Form 2022 Printable, ⚓ the minimum wage moves to $14 per hour (and then $15 on jan. Start here to set up your account.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Tax rates used in the withholding methods continue to range from. These tax tables are used for the tax and payroll.

Source: oforms.onlyoffice.com

Source: oforms.onlyoffice.com

Form W4 (Employee's Withholding Certificate) template, This page contains the tax table information used for the calculation of tax and payroll deductions in rhode island in 2024. Effective january 1, 2024, unemployment insurance tax rates will remain at schedule g, with rates ranging from 1.1 percent to 9.7 percent.

Source: kalaqemelina.pages.dev

Source: kalaqemelina.pages.dev

W4 Form 2024 How To Fill Out Mona, The rhode island division of taxation has released the state income tax withholding tables for tax year 2020. Here’s a roundup of some of the most significant ones:

Source: templates.udlvirtual.edu.pe

Source: templates.udlvirtual.edu.pe

Free Printable W 4 Form For Employees Printable Templates, Start here to set up your account. Here’s a roundup of some of the most significant ones:

Source: blog.pdffiller.com

Source: blog.pdffiller.com

w4formemployeeswithholdingcertificate pdfFiller Blog, Those with more than $50,000 worth of tangible assets. Rhode island's earned income tax credit increases to 16% in 2024.

Rhode Island State Income Tax Withholding.

Here’s a roundup of some of the most significant ones:

Washington — The Internal Revenue Service Announced Today Tax Relief For Individuals And Businesses In Parts Of Rhode Island That Were.

Ric foundation payroll deduction form;